Why ROI is critical for continuous improvement

Recent Blogs

Not an attack, an act of accountability

Why AI won’t save a broken project

Belonging Before Performance: why culture eats capability for breakfast

You’re allowed to outgrow old versions of yourself

From Assigned to Accountable: Why title alone isn’t leadership

Leading in the Grey

Why Project Teams should start with curiosity, not connection

Unlearning is the leadership skill nobody talks about

Conflict handled well is a doorway to trust

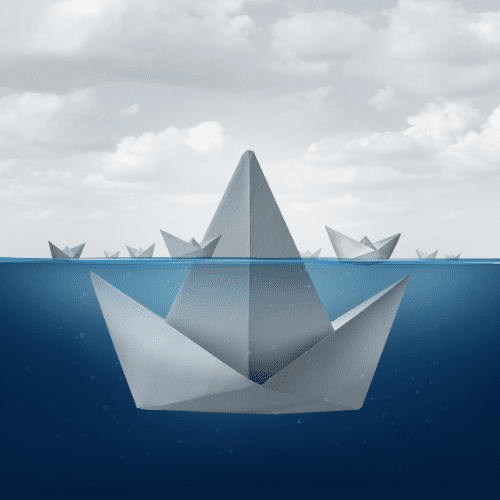

In project methodologies, the term ROI – return on investment – has long been a cornerstone. It’s how we quantify the tangible benefits of proposed changes: increased efficiency, improved customer satisfaction, or enhanced revenue streams. But there’s another lens for evaluating ROI that’s gaining momentum: Risk of Inaction. This reframing shifts the focus from the benefits of doing something to the potential costs and risks of doing nothing.

The concept of “Risk of Inaction” resonates particularly with result driven organisations. Businesses that cling to the status quo risk falling behind competitors, missing growth opportunities, or suffering long-term damage to their reputation. For project sponsors and their project teams, understanding and articulating these risks is becoming as essential as highlighting potential benefits.

Let’s explore why “Risk of Inaction” is critical for continuous improvement and effective decision-making, how project teams can assess these risks, and practical ways to integrate this perspective into project proposals.

Broadening the ROI Perspective

Traditional ROI calculations focus on the “gain”: What will we achieve by investing in this initiative? While that is undoubtedly important, it paints only half the picture. The other half lies in the consequences of standing still. Organisations face risks every day, and inaction can amplify those risks in significant ways.

Consider these scenarios:

- Market Disruption: A company ignores industry shifts like automation or AI integration. Over time, competitors adopting these innovations gain a clear edge, leaving the straggler struggling to remain relevant.

- Regulatory Compliance: Delaying action on systems updates to meet new regulations could lead to fines, operational shutdowns, or loss of licenses.

- Talent Retention: Failing to modernise tools and processes frustrates employees, leading to higher turnover and the associated costs of rehiring and retraining.

The risk of inaction often goes unnoticed because it doesn’t create an immediate crisis. However, it’s the slow erosion of competitive advantage or operational stability that can have the most devastating long-term effects.

A Framework for Assessing Risk of Inaction

Project sponsors and project managers play a vital role in surfacing the risks of inaction and ensuring these are factored into decision-making. Here’s a framework to guide this assessment:

Identify the Risks

Start by understanding what “inaction” means in the context of your project. What will happen if this initiative doesn’t proceed? Break down the risks into categories such as:

- Strategic: Loss of market share, inability to capitalise on emerging trends.

- Operational: Increasing inefficiencies, outdated technology.

- Financial: Higher costs over time due to deferred maintenance or reactive problem-solving.

- Reputational: Perceived stagnation or resistance to change by customers and stakeholders.

Quantify the Impact

Assign a dollar value or measurable outcome to each identified risk. Quantifying risks creates urgency and frames inaction as a concrete threat. For example:

- Delayed system upgrades could result in a $2 million compliance fine.

- Market disruption could lead to a 10% loss in revenue over three years.

Conduct Scenario Analysis

Create “What if?” scenarios to explore the consequences of inaction over different time horizons. For example:

- What will the business look like in one year, three years, or five years if nothing changes?

- How will competitors or external forces evolve during that period?

Engage Stakeholders

Collaboration is key. Bring diverse perspectives into the analysis by consulting key stakeholders, including team members, executives, and external partners. Their insights can help paint a fuller picture of the risks.

Leadership Accountability in Action

Project sponsors are uniquely positioned to champion this expanded ROI perspective. Their role isn’t just about greenlighting projects – it’s about guiding organisations to make informed, forward-thinking decisions. Highlighting the risk of inaction provides leaders with the clarity they need to align projects with long-term strategic goals.

For example:

- A project sponsor overseeing a digital transformation initiative can emphasise how failing to act will leave the organisation reliant on outdated technology, compromising customer satisfaction and increasing operational costs.

- By framing the conversation around what is at stake if no action is taken, the sponsor shifts the narrative from “Why should we do this?” to “Can we afford not to?”

This approach not only strengthens business cases but also fosters a culture of continuous improvement and proactive leadership, where decisions are made with an eye toward sustainable growth and resilience.

Practical Integration into Project Proposals

To ensure the “Risk of Inaction” is effectively communicated, project teams should embed this perspective into their project documentation and discussions. Here’s how:

- Dedicated Section in Business Cases: Create a standalone section titled “Risk of Inaction” to explicitly outline the consequences of maintaining the status quo.

- Data-Driven Presentations: Use charts, graphs, and case studies to visually demonstrate the cost of inaction alongside traditional ROI metrics.

- Stakeholder Workshops: Facilitate sessions with decision-makers to explore the risks collaboratively, ensuring alignment and buy-in.

- Ongoing Advocacy: Revisit and reiterate the risks of inaction throughout the project lifecycle to maintain focus and urgency.

In the end, reframing ROI to include “Risk of Inaction” isn’t just a shift in terminology – it’s a shift in mindset. By acknowledging and addressing the potential costs of inaction, project sponsors and project teams can help organisations make more balanced, informed decisions.

The next time you evaluate a project, consider not just the gains you stand to achieve but also the losses you risk by staying still.

The cost of doing nothing may be the most expensive decision of all.